FLOOR Sweeping Treadmills

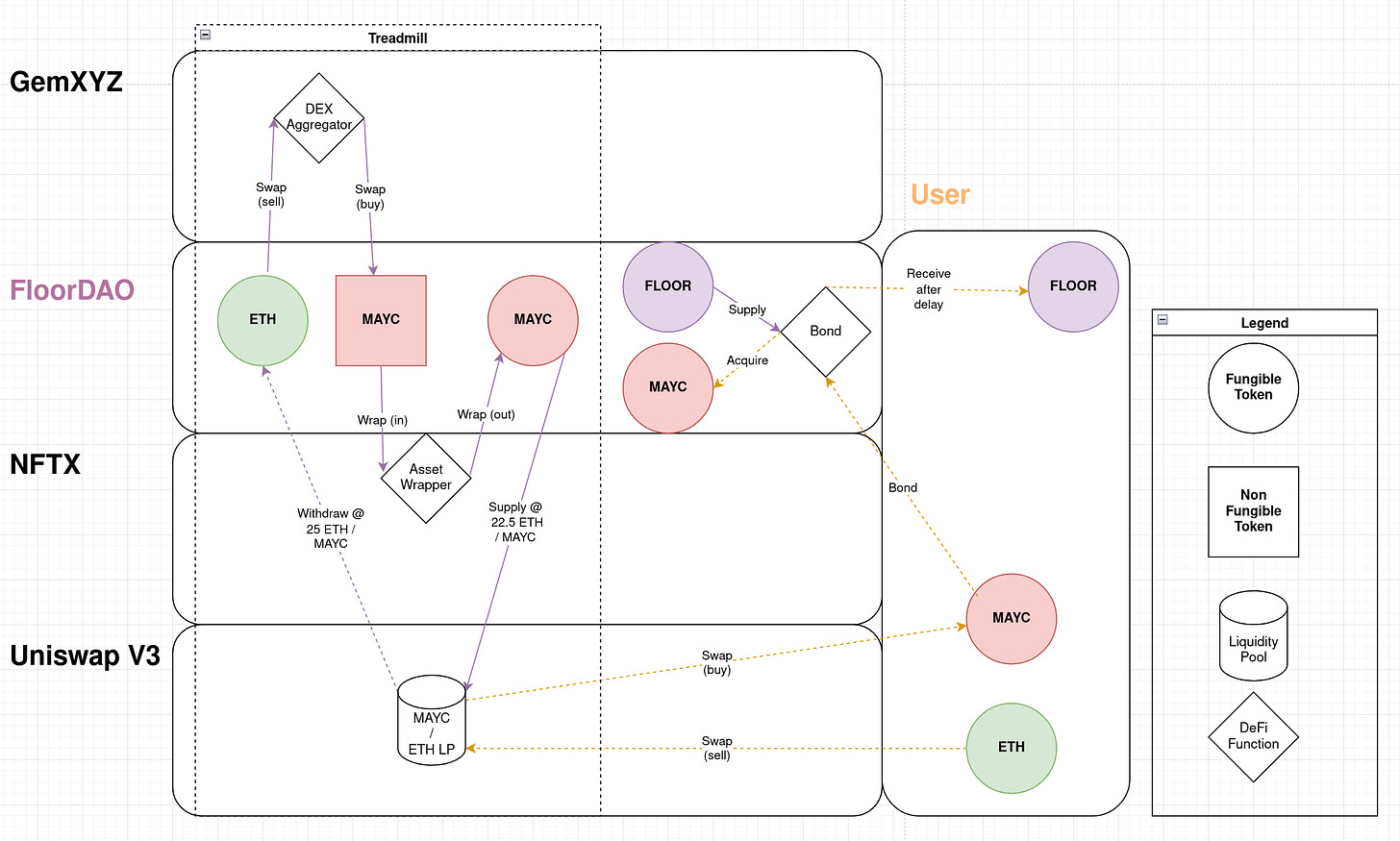

Exploring FloorDAO's use of Uniswap v3 LPs to acquire NFTX wrapped NFTs with Olympus Bonds

Disclosure, I have the great pleasure of advising FloorDAO.

Discussing their MAYC bond series with the team had me geeking out, and I want more people to geek out with me. I hope you enjoy.

0) Intro NFT Market Mechanics

Order books are the dominant way to trade NFTs, but like the fungible DEX’s before them, orderbook performance is limited. Due to this we see many experiments toward more pooled asset markets ranging from the up and coming sudo swap to the reliable, establised NFTX.

Order Books

Order books are by default a manual process, though savy users can wrap the expirience in automated bots. This default expirience causes listed asks to go stale relative to the most recent market activity. It also isolates sales to a specific asset, making it harder to produce pooled strategies.

NFTX

NFTX creates floor indecies of NFTs by using a wrapper contract which fungibly represents the assets held by the wrapper. This allows listing NFTs on AMM’s such as Sushi, and therefore enables pooled ownership of liquidity in an automated manner.

Uniswap V3

Offering concentrated liquidity, when paired with NFTX indecies, allows for nuanced control of lazy market making. In my expirience combining NFTs with uniswap v3 is quite rare.

1) Intro FloorDAO

FloorDAO focuses on acquiring floor assets of NFT collections to bootstrap the floor liquidity DeFi economy. While NFTX provides a way to create and sustain a market for floor assets, it does not incentivize liquidity in any market (though it has its own stash of PUNKs from its initial raise).

Like all things, low liquidity is problematic, especially for the full range pairs incentivized by NFTX on Sushi. They need volume to generate fees, and they need liquidity to generate volume. Chicken and the Egg.

FloorDAO is dedicated to addressing this gap by collectively providing liquidity to these collections to earn the fees the available markets will generate. However this requires it to solve tricky problems like how to acquire that liquidity and how to determine which collections are supported.

Bonds

In order to acquire protocol owned liquidity for market making, FloorDAO offers bonds where it sells FLOOR at a discount with a short locktime in exchange for NFTs.

The absolute best resource for understanding Bonds so far is this blog by Jordan Hall.

2) Sweeping MAYC

Initial Market Conditions

NFTX Vault Contains:

5 MAYC

Sushi Pool Liquidity

7.85 WETH

0.31 MAYC (NFTX Vault)

Mutant Ape Yatch Club Floor Price

22.4 ETH

Goals

Sell out MAYC bonds

Users must acquire MAYC

Through purchase

Through existing asset

Users most likely to bond while mechanism offering a discount

Provide an easy way for Users to acquire the MAYC to bond.

If through purchase, by low slippage buys of partial units.

If through existing assets, by low slippage sells of remaining partial units.

Unique Problems

NFTX has a minting fee, but FloorDAO has a deal which avoids this fee.

the price of the bond is dependent on the relationship between the NFT price and FLOOR price, but 10%/ swing in realized value can impact the attractiveness of bonds.

FloorDAO has ETH,

wants to have bonding for MAYC,

Bonding in current market

hard for folks to acquire MAYC in partial units without buying whole unit, selling remainder of partial at high slippage.

To provide adequate full range liquidity to minimize this slippage would require significant capital and require sweeping a large amount of the floor ourselves to provide both sides.

Mapping Out The System

Create uni v3 pool between NFTX wrapped wMAYC, and ETH

with narrow range,

single sided entry of only wMAYC,

which sells for ETH w/ price sliding up

as price slides up, has ETH available to buy MAYC

if price drops quickly, wont eat sells from outside holders

if price moves can adjust range

FloorDAO owns 75% of staked NFTX MAYC positions and would earn 75% of fees generated by new mints seeking bonds.

FloorDAO does not pay NFTX fees to wrap

Outside arbitrage can occur if we buy remaining MAYC at a 10% premium

Initial Approach

Create a small full range v3 position to give us flexibility to move price when we withdraw our primary position

Create a concentrated range position of MAYC from current price to a 10% premium.

At a 10% premium, outside forces, will be able to mint on NFTX and sell the remainder

This performed beyond my expectation, and sold out extremely quickly processing through the position with barely any slippage and minimal market liquidity was needed to facilitate.

Refinements For Second Approach

After the first set of bonds sold out, we exited position 2. The outside arb was not arriving in a timely fashion, and our pool was now mostly ETH.

We made a small trade against position 1 to move the price down from the premium to the current Floor on Order Books.

We then swept the MAYC floor w/ Gem.xyz again and resupplied liquidity. This time we only chose to extend the range from the current floor up to a 5% premium since we were now more attuned to arb order books ourselves and didn’t need to tempt outside capital with a premium. This allowed even more efficient entry into our bonds.

3) Closing Thoughts

By using a Treadmill Approach, we were able to minimize the upfront liquidity the DAO needed to effectively bundle purchases of whole NFT’s and then recapture that upfront cost in ETH by selling in a small range. This put us in a position to repeat the process and slowly increase the floor through sweeps, on a collection which did not have deep available liquidity.

Buy, sell, bond, repeat.

By using two positions in a pool of our creation we were able to easily manaage removal and resupply of Position 2 with Position 1 ready for price adjustments, simplifying accounting.

This process also enabled us to earn additional yield from the bonding process.

I think this process will be very useful for any future applications trying to acquire NFT’s with low liquidity, and look forward to how it can become more automated in time.